If the Friedman supporting N-GDP targeting is not something that you find surprising or interesting, this post is not for you, it’s just too far down the rabbit hole of economic politics (trust me, you're glad you haven't been sucked in)

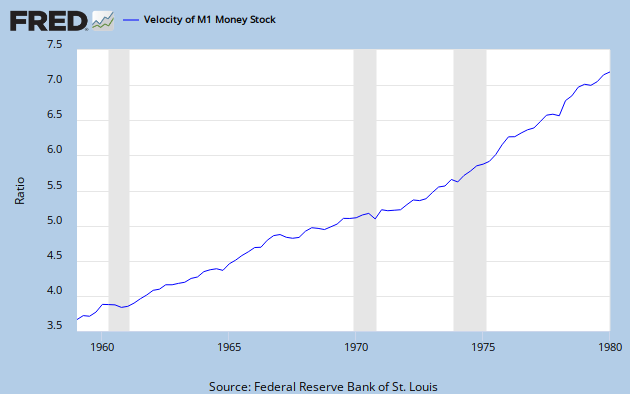

Back in 1968, Milton Friedman gave a speech on monetary policy, in which he suggested that, because the velocity of money, that is to say the rate at which money changes hands, is more or less stable (or at least grows at a predictable rate), the Fed should simply aim to increase the total money supply at a constant rate, and let the rest of the economy work itself out.

In 1968, in fact until 1980 or so, this “steady velocity” assumption was reasionable:

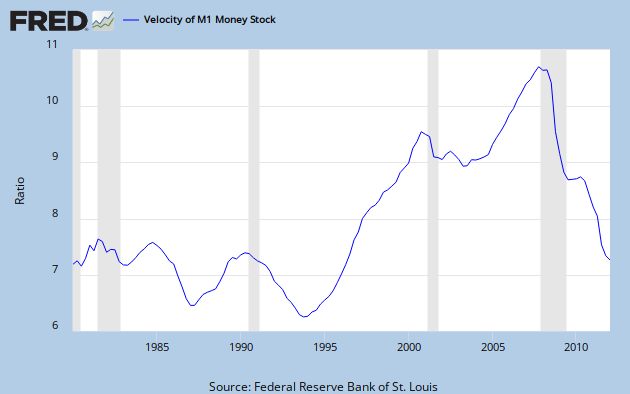

After 1980, however, money became electric, credit cards became ubiquitous, and the relationship between M1 and rate of economic activity broke down. Suddenly, velocity was not so stable after all. Velocity of the money supply following 1980:

.

.So, if you were targeting M1 before, but then realized that velocity were not so stable after all, what you’d want to do is target M1, adjusted for velocity. That would be, your would target M1V, so if V fell, you would adjust M1 upwards to compensate. This would be perfectly in line with Milton Friedman’s vision, eminently conservative in its effort to create a non-interventionist monetary policy, and since MV is the same as Nominal GDP, it would be NGDP targeting. So: Milton Friedman would have liked NGDP Targeting.

No comments:

Post a Comment